There’s an old adage: You get what you get, and you don’t get upset. Clearly, that doesn’t apply to retail. For some time now, the axiom has been customers want what they want, when they want it. And Covid-19 accelerated that. Apparel shoppers want choices, and they want the stores and clothes to reflect their local tastes and demands. And they still want what they want when, where and how they want it delivered.

Post-Pandemic Paradigms

Coresight Research says the pandemic “accelerated consumer disinterest in homogeneous physical retail experiences.” Instead, shoppers are seeking experiences that are local, distinctive and diverse. The firm advises retailers consider localizing in-store experiences and product offerings. Coresight adds that mall owners can support its tenants with localized center experiences.

Capgemini’s Smart Retail Planner suggests stores use sales history, industry data, product attributes, and hierarchy structure, as well as artificial intelligence (AI) and machine learning to “help drive the creation of localized assortments.”

The pandemic accelerated consumer disinterest in homogeneous physical retail experiences. Instead, shoppers are seeking experiences that are local, distinctive and diverse. Retailers and mall owners can respond by delivering localized experiences and product offerings.

Most consumers just want retailers to have what they want, as if by magic. Two-thirds of shoppers (66 percent) say they wish apparel brands and retailers knew more about what they like and how they shop, according to the 2020 Cotton Incorporated Lifestyle Monitor™Survey.

Streaming Retail

And apparently, that’s quite possible. In a recent webinar titled “Age of Precision Category Management,” Coresight’s Deborah Weinswig, founder and CEO, said stores may want to draw inspiration from the world’s largest streaming platform.

“We had talked about this idea of a Netflix-type approach where, if one of us is watching horror movies and one of us is watching sappy movies, the horror lover will continue to get horror as opposed to sappy movies,” Weinswig said. “So, there’s this idea around smarter stores, smarter clusters and what we can learn from that at an organization level.”

Weinswig was speaking with Hivery‘s Steve Weir, vice president of client services, and Zach Simpson, director of customer success. Hivery is an artificial intelligence company that offers prescriptive solutions for hyper-local retailing. Weir says his company’s approach to clustering is similar to the way Netflix suggests titles for viewers.

“Netflix, thank goodness, doesn’t care who I am. It only cares what I like,” Weir said. “If it cared who I am, it would lump me and Zach into the exact same bucket, and we would be served content in the exact same way. Yet, Zack likes to watch romance comedies and I like to watch things that blow up.

Predictions and Behavior

“So, our view of the best predictor of purchase behavior is purchase behavior,” Weir continued. “We study that and map where purchase behavior is similar across stores within a particular category. From there, we’re able to say, ‘You should do store-specific assortments in up to 30 percent of your stores, and then go clustering with the rest. And here’s the ideal number of clusters based on what’s being purchased.’ Because ultimately, retail cares about what’s being purchased more than they care who is purchasing it.”

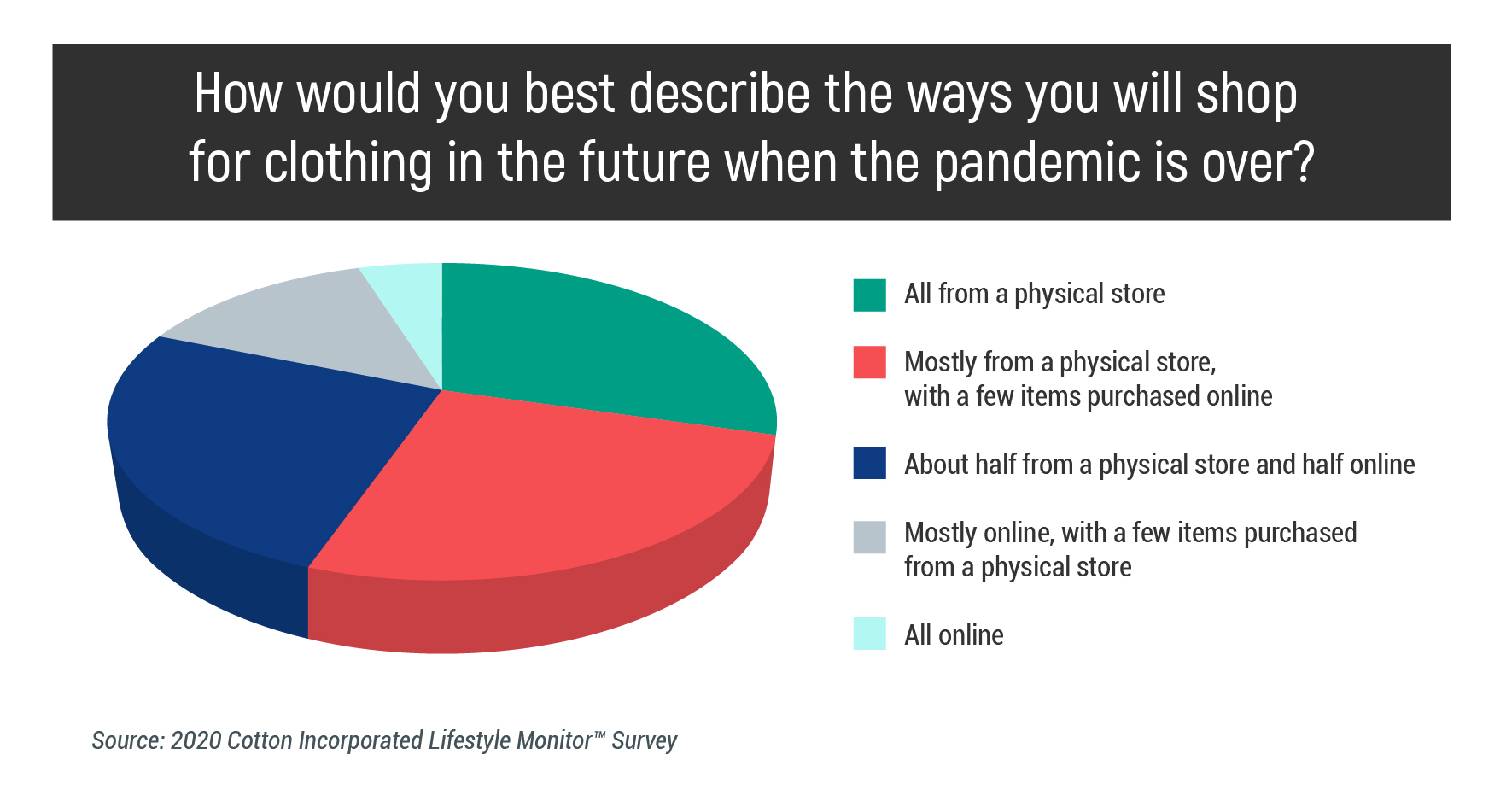

This focus on in-store shopping takes into account that not everyone is comfortable buying their clothes online, even though a lot of activities — including clothes shopping — moved to the internet during the pandemic. Nearly half of all shoppers (49 percent) said they bought clothes online during the pandemic, and 41 percent say they plan to continue doing so in the future, according to Cotton Incorporated’s Coronavirus Response Consumer Survey, (Wave 6, May 19, 2021). But more than half (52 percent) say they will buy their clothes in person going forward. And that’s where a crystal ball could come in handy.

Data-Driven Delivery

Technology needs to play a paramount role for categories to expand, Weinswig said.

“Incremental category growth requires the ability to have the right product, right store, right time,” she says. “Poor execution at the store level really does have a significant impact on sales. So, whether an item is out of stock, or in the store but on a different shelf, or it’s still in the back of the store, we’re talking an impact that’s very sizable.”

A 2018 report from Coresight Research and Celect found that misjudged inventory decisions — including overbuying, buying the wrong type of products and misallocating inventory — accounted for about 53 percent of unplanned markdowns for nongrocery retailers, or about $300 billion in lost revenues.

In the upcoming year, U.S. consumers expect their spending on clothes to be the same (37 percent) or more (45 percent) than last year, according to the Coronavirus Response Survey (Wave 6). While the majority of consumers (73 percent) bought all (43 percent) or most (30 percent) of their clothes from a physical store before the pandemic, COVID restrictions changed things. During the pandemic, that number dropped to 45 percent, all (23 percent) or most (22 percent).

In-Store Prevails

Going forward, only 19 percent of shoppers plan to go online for all (5 percent) or most (14 percent) of their apparel purchases, according to the Coronavirus Response Survey (Wave 6). The reality is 61 percent of consumers feel shopping for clothes online is “a poor substitute” for shopping in person in a physical store. Consumers say they plan to shop online less because they enjoy the experience of shopping in a store (36 percent). Consumers also feel shopping in-store is more convenient (33 percent), they often need to return clothes they purchase online (32 percent) and it’s important for them to try on clothes before purchasing (17 percent).

Intelligence Node, a retail software solutions provider, says since today’s consumers have access to so many channels, websites, search engines, etc., it will take more than just low prices or discounts to convert them.

“You need diverse product assortments for consumers to choose from and need to keep evaluating your merchandise based on consumer preferences, competitor offerings and shopping trends,” the firm states. “Instead of keeping the same assortments online as well as in-store, study your consumer demographics and patterns, and curate your assortments to meet the consumer demand across each channel.

Tech-Human Hybrid

In an ideal world, Weir says Hivery sees tech augmenting the human component of retailing. “What we need to do as an industry is shift out of doing and into thinking, because computers are way better at math than we are,” Weir said. “They don’t get bored, they don’t mind working at night or on the weekend so let AI do what it has been created to do. And honestly, let people do what people have been trained to do, which is look around the corners, think outside of the box and be creative. That’s where retail and CPG will actually bring more value to each other. By reducing the operational headache that goes into preparing insights and actions, technology frees up time to actually be more creative and strategic.”

About Catherine Schetting Salfino

Catherine Schetting Salfino covers fashion and retail. Her work has appeared in the menswear publications Daily News Record, Women’s Wear Daily, Saks POV, and the Sourcing Journal.

About The Robin Report

The Robin Report provides insights and opinion on major topics in the retail apparel and related consumer product industries. It delivers provocative, unbiased analysis on retail, brands and consumer products, and covers industry-wide issues, trends and consumer behavior throughout the retail-related industries. TRR is delivered exclusively on TheRobinReport.com. Additionally, TRR produces executive briefings and industry events.

If you are not yet a BRA Retail Member, you can easily opt in to either Regular (no cost) or Distinguished ($99/yr.) Membership via this super simple join form